Why a Secured Credit Card Singapore Is Crucial for Structure Your Credit Rating

Why a Secured Credit Card Singapore Is Crucial for Structure Your Credit Rating

Blog Article

Charting the Path: Opportunities for Bank Card Gain Access To After Insolvency Discharge

Navigating the globe of credit history card accessibility post-bankruptcy discharge can be a complicated task for people looking to rebuild their monetary standing. The procedure entails calculated preparation, understanding credit rating details, and exploring numerous choices offered to those in this particular scenario. From secured charge card as a tipping rock to prospective courses bring about unsecured credit history possibilities, the journey in the direction of re-establishing creditworthiness needs mindful factor to consider and notified decision-making. Join us as we explore the opportunities and techniques that can lead the way for people seeking to restore accessibility to charge card after encountering insolvency discharge.

Understanding Credit Rating Fundamentals

A credit scores score is a numerical representation of an individual's creditworthiness, indicating to loan providers the degree of risk associated with prolonging credit rating. A number of variables contribute to the calculation of a credit history rating, including repayment history, amounts owed, length of credit scores background, new credit rating, and kinds of credit score used. The amount owed loved one to readily available credit scores, likewise understood as credit utilization, is another vital variable affecting credit report ratings.

Protected Credit Rating Cards Explained

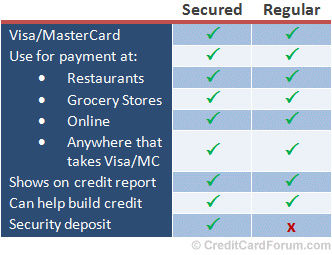

Secured charge card provide a useful financial device for individuals looking to rebuild their credit score history complying with a personal bankruptcy discharge. These cards require a safety down payment, which generally determines the credit line. By utilizing a secured charge card responsibly, cardholders can show their credit reliability to potential lending institutions and slowly improve their credit history.

Among the crucial benefits of safeguarded bank card is that they are much more easily accessible to people with a restricted credit report history or a damaged credit rating - secured credit card singapore. Because the credit scores limitation is protected by a down payment, issuers are a lot more going to approve candidates who might not qualify for traditional unprotected credit score cards

Bank Card Options for Rebuilding

When seeking to reconstruct credit after bankruptcy, discovering numerous credit scores card alternatives customized to individuals in this economic circumstance can be useful. Safe credit history cards are a preferred selection for those looking to rebuild their credit score. Another choice is ending up being an accredited individual on a person else's credit scores card, permitting individuals to piggyback off their debt history and potentially increase their own score.

Exactly How to Get Unsecured Cards

To receive unsecured credit scores cards post-bankruptcy, people need to show enhanced credit reliability via liable financial administration and a background of on-time repayments. One of the main steps to get approved for unsecured charge card after personal bankruptcy is to constantly pay bills promptly. Prompt repayments display responsibility and reliability to prospective creditors. Maintaining low charge card equilibriums and staying clear of building up high degrees of financial debt post-bankruptcy also boosts credit reliability. Monitoring credit history reports consistently for any mistakes and disputing inaccuracies can better enhance credit rating, making people more eye-catching to charge card companies. In addition, people can think about using for a safeguarded bank card to rebuild credit report. Guaranteed credit scores cards call for a money deposit as security, which minimizes the threat for the issuer and enables people to demonstrate responsible debt card usage. Gradually, accountable economic practices and a favorable credit rating can result in qualification for unsafe charge card with far better incentives and terms, assisting individuals rebuild their economic standing post-bankruptcy.

Tips for Liable Credit Rating Card Use

Structure on the structure of enhanced credit reliability his response established through responsible economic monitoring, individuals can improve their total monetary wellness by implementing vital ideas for responsible charge card use. Firstly, it is important to pay the full statement balance on schedule monthly to stay clear of gathering high-interest charges. Establishing automated settlements or reminders can assist make certain timely payments. Secondly, keeping an eye on investing by consistently keeping an eye on credit rating card statements can stop overspending and assistance determine any kind of unapproved deals immediately. Additionally, keeping a low credit report use proportion, preferably below 30%, demonstrates liable credit rating use and can positively impact credit rating. Staying clear of cash money breakthroughs, which usually include high charges and rate of interest, is additionally a good idea. Finally, abstaining from opening several brand-new charge card accounts within a brief period can prevent prospective credit history rating damages and extreme financial obligation accumulation. By adhering to these ideas, people can leverage bank card properly to rebuild their financial standing post-bankruptcy.

Verdict

Finally, people who have declared insolvency can still access bank card through different choices such as secured charge card and reconstructing credit score (secured credit card singapore). By recognizing credit rating rating basics, receiving unprotected cards, and exercising responsible charge card usage, individuals can progressively rebuild their credit reliability. It is vital for individuals to carefully consider their monetary situation and make notified decisions to boost their credit history standing after bankruptcy discharge

A number of aspects contribute to the estimation of a credit score, including payment background, amounts owed, Look At This length of credit score background, new credit, and kinds of credit history used. The quantity owed family member to offered credit rating, additionally known as credit report use, is one more vital variable influencing debt ratings. Checking credit reports frequently for any check that mistakes and challenging mistakes can further enhance credit history ratings, making people more attractive to credit report card companies. Furthermore, preserving a low credit scores use ratio, preferably listed below 30%, demonstrates liable credit rating use and can favorably impact credit report scores.In verdict, people who have filed for personal bankruptcy can still access credit report cards with various choices such as safeguarded credit report cards and reconstructing credit scores.

Report this page